The Bitcoin white paper has turned 15 years old. Meanwhile, Sam Bankman-Fried’s criminal trial continued on Oct. 30, where he was asked to explain his previous derogatory remarks toward regulators and CME now ranks second in the list of BTC futures exchanges.

Satoshi Nakamoto’s Bitcoin white paper turns 15

Today marks 15 years since the pseudonymous creator of Bitcoin, Satoshi Nakamoto, shared the Bitcoin (BTC) white paper to a mailing list of cryptographers on Oct. 31, 2008 — a date also annually celebrated as Halloween.

“I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party,” Satoshi famously said in the opening sentence before linking the document titled: “Bitcoin: A Peer-to-Peer Electronic Cash System.”

15 years ago today, the Bitcoin whitepaper was released

Who’s inscribing it to celebrate? pic.twitter.com/tHOjjd3ADc

— Udi Wertheimer (@udiWertheimer) October 31, 2023

The whitepaper proposed a decentralized system that could facilitate peer-to-peer transactions which could solve the “double spending” problem often associated with digital currency.

It proposed to achieve this via a network of nodes to validate and record transactions through a proof-of-work consensus mechanism, launching just two months later on Jan. 3, 2009.

Bankman-Fried grilled on his approach to crypto regulation

Former FTX CEO Sam Bankman-Fried was asked at his criminal trial to express his true feelings toward crypto regulation after it came to light that he had made disparaging remarks in the past.

Assistant U.S. Prosecutor Danielle Sassoon reportedly asked Bankman-Fried if he recalled his previous Twitter statements where he supported crypto regulation. “I don’t remember,” he said. Sassoon then asked, “But in private, you said, fuck regulators, right?”

“I said that once,” he replied.

OK – now SBF trial with Sam Bankman-Fried still on direct, this afternoon the cross. Inner City Press is on it https://t.co/lPLqNVJIBf &https://t.co/mdnD76vUQ7 Exhibits https://t.co/VGsnx6gqxd book https://t.co/1w2tkmrTvA and will live tweet, thread below pic.twitter.com/HmDmEG3fL8

— Inner City Press (@innercitypress) October 30, 2023

Bankman-Fried’s criminal trial is expected to conclude early next week. The former FTX boss faces a slew of criminal charges, including wire fraud, securities fraud and money laundering. He has pleaded not guilty to all charges put forward by the prosecution.

CME becomes second-largest Bitcoin futures exchange as open interest surges

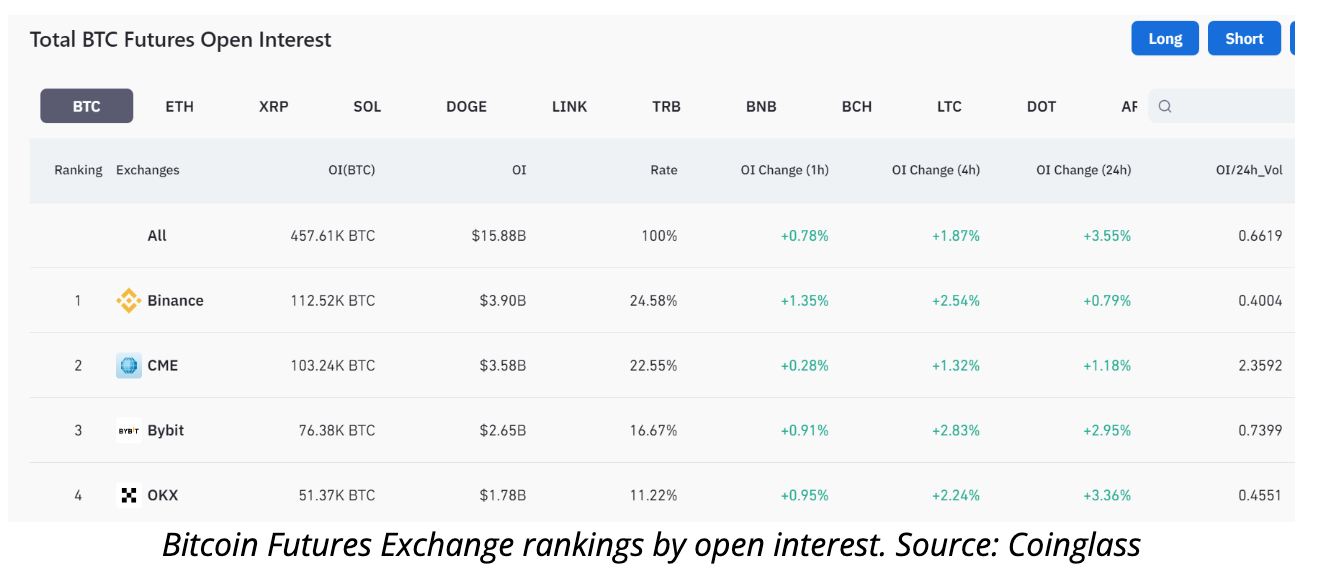

The Chicago Mercantile Exchange (CME), a regulated derivatives exchange that lists Bitcoin BTC futures, now stands just behind Binance in terms of notional open interest to rank second in the list of BTC futures exchanges.

CME’s open interest hit $3.58 billion on Oct. 30, pushing the regulated derivatives exchange platform to jump two positions from the previous week. The CME overtook Bybit and OKX with $2.6 billion and $1.78 billion in open interest, respectively, and is just a few million away from Binance’s $3.9 billion.

CME’s rising open interest not only helped the regulated futures exchange to climb to the second spot among futures crypto exchanges but also saw its cash-settled futures contracts exceed 100,000 BTC in volume. The rising interest of traders in the Bitcoin futures market has also propelled the CME to attain 25% of the Bitcoin futures market share.

A majority chunk of investment into CME futures has come via standard futures contracts, indicating an influx of institutional interest as Bitcoin registered a massive double-digit surge in October, helping it reach a new one-year high above $35,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.